In recent years, the GP-LP relationship has evolved as the private markets took an understandable downturn. Prior to the COVID-19 pandemic, GPs held a great deal of sway in negotiating LPAs and side letters. However, the dynamic has shifted, giving LPs more power to demand their preferred terms and better economics.

This doesn’t imply an adversarial relationship. The new dynamic is simply the result of a maturing industry facing numerous headwinds, from macro uncertainty to higher interest rates and regulatory scrutiny.

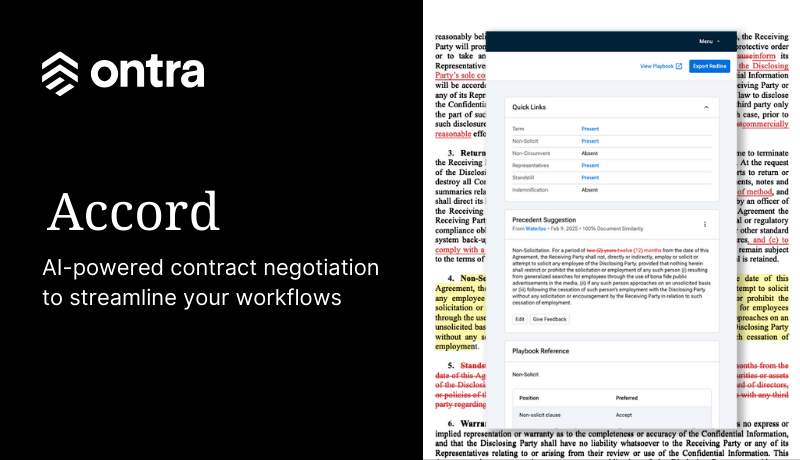

Recent GP-LP relationships have resulted in GPs needing to be better able to meet LP demands, such as user-friendly MFN elections for more investors and robust reporting. To do that, leading GPs are letting go of their legacy tech and processes in favor of advanced legal tech and automation. At this point, there’s too much to do and too many questions to answer to continue relying on slow, manual processes.

Let’s examine the changing GP-LP relationship and how AI legal tech like Ontra’s private markets technology platform can give GPs a competitive edge in tough times.

Selective LPs have created a tough fundraising environment

Throughout 2024, investors have been selective in choosing where to place their capital given there have been fewer exits and distributions in recent years. According to Preqin, global private equity fundraising fell to $134.6bn in Q3 2024 compared to $178bn in Q1. When they do invest, LPs have favored more mature, well-known fund managers and more diversified investment strategies, leaving emerging fund managers struggling to build new investor relationships.

As GPs grappled with fundraising in 2024, some lowered their fundraising goals and extended deadlines. Private Fund CFO’s Insights Survey 2025 found:

- 36% of respondents extended their fundraising period

- 23% adjusted their target size

- 21% targeted investors in new geographies

- 13% delayed a fund launch

- 9% altered the structure or terms of a proposed vehicle

According to Proskauer, LP due diligence has also increased. For instance, Private Funds CFO reported that investors are keeping a close eye on distribution to paid-in multiples (DPI) to evaluate GPs and investment opportunities. GPs that advertise a strong DPI while fundraising can expect investors to scrutinize how the GP has generated distributions for their LPs recently.

LPs are pushing for better terms

Once upon a time, side letter and LPA negotiations rarely extended beyond cornerstone investors. Recently, however, GPs have been experiencing extensive negotiations with a larger group of investors, including those with a lower threshold investment amount. Proskauer found many LPs are pushing back on what they consider aggressive terms and demanding better economics.

When GPs seek material changes or specific terms, investors want the GP to clearly articulate a reason. Investors aren’t as eager to accept terms they might have settled for in previous funds. Areas up for negotiations tend to include co-investment opportunities, portfolio company fees, management fees, and fee offsets.

Don't miss Ontra's expert insights

Join our newsletter to stay up to date on features and releases

By subscribing you agree to our Privacy Policy

Thanks!

LPs are asking for transparency and detailed data

LP requests for information and ongoing reporting have become more comprehensive throughout 2024 — an annual report may not be enough anymore. During the Private Funds CFO New York Forum in early 2024, the publication found investors are requesting more detailed information, and many want more standardized formats.

Investors are asking more sophisticated questions and want granular information on the fund’s fees and expenses and portfolio companies’ performance. In the past, LPs focused on fund-level insights. Now, they are much more invested in portfolio-level information, given the need to focus on margins to drive value.

LPs continue to demand liquidity in a depressed exit environment

Given the lower exit numbers in recent years, LPs have become louder in their demand for liquidity. This has led to a variety of strategies to provide distributions, including more Net Asset Value (NAV) loans, continuation funds, cross-fund transactions, dividend recapitalization, and partial exits.

No matter the GP’s strategy, LPs are heavily focused on valuations. They expect a thorough process and want to understand the GP’s methodology and data. A CFO/CCO of a healthcare private equity firm told Private Funds CFO during its New York Forum that investors want to be able to recalculate their returns — they aren’t asking for data for the sake of it.

What does the new LP stance mean for GPs?

A heightened focus on transparency resulting in additional side letter negotiations, bespoke terms, detailed reporting, and MFN requirements means GPs need a strong grip on their side letter compliance programs, including legal tech that provides:

- A single source of truth for all LPA and side letter obligations.

- A fast, efficient way to review and compare previously negotiated side letters.

- A scalable and cost-effective MFN process.

Ontra’s Insight platform modernizes fundraising and simplifies compliance processes. Insight leverages AI to digitize legal documents and create a searchable, digital compendium.

With this single source of truth, GPs can easily compare side letter provisions, use AI Search to surface actionable insights, and closely monitor their compliance efforts through multi-stakeholder task workflows. GPs can also leverage Insight’s digital MFN elections to create and distribute forms, track progress, and accept LP elections.

Given LP demands for transparency, GPs may agree to more frequent reports. Insight offers a digital disclosure process through which GPs can consolidate information, redact confidential information, and distribute reports to relevant investors.

Lean into AI legal tech

Building and strengthening investor relationships is more important than ever for GPs of all sizes. Even the largest, most established GPs can’t take their strategies and value for granted.

While the industry is largely optimistic about 2025, GPs should continue to adopt and leverage AI legal tech to build a competitive advantage. With advanced technology on their side, GPs can expertly negotiate with investors, track their obligation compliance, and provide user-friendly MFN forms and disclosure reports.

To learn more about Insight, schedule a demo today.