Private equity general counsel are strained. According to Gartner, 74% of lawyers reported experiencing exhaustion. Legal departments, especially in private equity, are resource-constrained and can’t always increase headcount or incur the additional expense of shifting their work to law firms.

Despite their constraints, private equity legal teams face some of the most complex and nuanced legal tasks. Stakes are high, drafting is nuanced, specific language choices are important, and understanding industry norms and nuances is essential.

Increasingly, GCs in private equity are looking to AI to ease the strain.

To fully leverage AI, GCs must understand which workflows can benefit the most and be cognizant of the risks and requirements involved in implementation. With this foundation, GCs can help their private equity firms take a responsible and thoughtful approach to AI adoption.

How in-house counsel in private equity uses AI

Generative AI (GenAI) won’t replace GCs or external counsel’s expert legal advice. However, it can do an excellent job of analyzing language and automating high-volume, routine tasks throughout the fund lifecycle, including:

- Private equity contract drafting: GenAI trained on private equity-specific legal agreements can generate first drafts of simple contracts. While AI-generated contracts should still be reviewed by legal professionals to ensure accuracy, this approach can save firms hundreds of hours in time and effort.

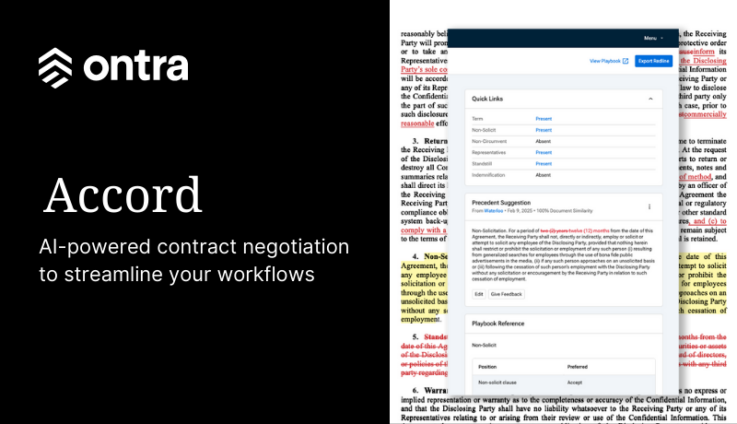

- Deal sourcing and negotiation: Private equity funds and investment banks review a significant number of investment opportunities, leading to a high volume of routine legal documents, such as NDAs, non-reliance letters, and engagement letters. AI can streamline the labor-intensive negotiation process for routine contracts, speeding up contract turnaround times and freeing GCs’ focus.

- Investment due diligence: AI can rapidly process large volumes of contracts and other data sources, enabling lawyers to speed up and improve legal due diligence and support commercial diligence on target companies without straining bandwidth.

- Surfacing prior transaction precedent: A sophisticated AI solution can analyze a document repository to surface precedent, cross-reference terms, and provide further visibility into a firm’s contracts.

- Contract data analysis and ongoing compliance: AI-powered contract automation and intelligence solutions can identify, summarize, analyze, and categorize contract clauses and data, quickly increasing visibility into a firm’s agreements while decreasing the legal team’s workload.

- Fund and side letter compliance: AI tools can power a searchable, digital repository of agreements and obligations, enabling GCs to easily monitor, act on, and report on contract obligations, including investor and fund obligations.

- Entity management: AI tools can streamline workflows to organize, manage, and share information for dozens, hundreds, or thousands of private equity entities, from fund and firm entities to alternative investment vehicles (AIVs), special purpose vehicles (SPVs), co-investment vehicles, and portfolio company entities. AI solutions can generate formation documents and structure charts, aggregate entity data and legal documents to create a single source of truth, and automate CTA and other compliance workflows.

- Regulatory reporting: AI can provide insights into the portfolio and contract data needed for regulatory reporting and examination preparation.

- Legal research: Instead of relying only on a standard search engine for legal research, firms can employ AI as another tool to supplement legal research.

- Administrative tasks: AI tools can help legal teams with many non-legal responsibilities, including billing, workflow management, time tracking, and scheduling.

Key considerations for private fund GCs championing AI

GCs can play a significant role in the adoption of AI tools within the legal team, across the firm, and — in some cases — at portfolio companies too. When considering AI solutions for legal teams or across the firm, GCs should:

- Develop and implement AI risk management policies

- Identify processes ripe for improvement and understand how specific AI solutions could be used

- Ensure the firm conducts robust vendor diligence

- Stay abreast of regulatory developments

1. Develop and implement AI risk management policies

A GC in private equity should work with their CCO and CTO to develop internal policies that govern AI use across the firm.

Gartner recommends aligning on four key focus areas:

- Permitted AI use cases: Collaborate with firm leadership to compile a list of appropriate AI use cases and the perceived risks for each. Comprehensive controls, like approval by an internal AI governance committee, are appropriate for high-risk use cases. Low-risk use cases might only warrant more basic safeguards.

- Firm-specific risk areas and risk tolerance: Define how common AI risks apply to the firm, including confidentiality, safeguarding of investor data or Personally Identifiable Information (PII), and/or protecting Material Non-Public Information (MNPI). Firms will need to assess their risk tolerance and the availability of risk mitigation options and may consider purchasing additional insurance.

- Risk ownership and decision-making: Determine who will make decisions about AI and who will be responsible for reviewing and approving tools or activities. Firms may form an AI governance committee, which may include the GC.

- Disclosures: Assess whether the firm needs to disclose its use of AI tools to investors or regulators, and if so, create policies and procedures for such disclosures. Policies should be documented, distributed, and monitored to ensure employees understand and comply with the firm’s requirements.

2. Identify processes for improvement and understand how AI solutions can be used

After defining permitted use cases, GCs should work with other department leaders to identify and assess current processes that may be ripe for improvement. Only by acknowledging departments’ pain points can GCs and their teams evaluate how an AI tool might be able to help and how employees would use the tool to see a return on the firm’s investment. GCs need a clear understanding of functionality when evaluating AI tools for use by various departments, particularly if an intended use case involves investment decisions, PII, or MNPI.

During this process, ask a lot of questions. GCs and CCOs will ultimately bear responsibility for ensuring the firm responsibly selects AI tools, follows policies and procedures, discusses AI appropriately in marketing materials, and makes any necessary disclosures.

3. Conduct robust vendor diligence

Get involved early when departments research AI tools. Create diligence checklists, join demo calls, and ask questions. When assessing and negotiating with vendors, consider whether, among other things:

- Proprietary or personally identifiable information could be exposed externally

- If and how the firm’s data will be saved and used by the vendor

- Any of the firm’s data could be used to train external or public AI models

- The AI tools have been developed with industry-specific data

- The AI tool has a tendency to hallucinate or misunderstand prompts

Effective AI tools for private equity will likely require training on high-quality, industry-specific data to be worthwhile, and given the complexity of private equity transactions, outputs will likely require human review and validation.

4. Stay abreast of regulatory developments

Collaborate with the CCO to track law-making and regulatory activity for AI broadly and for the private equity industry specifically. Keep up-to-date on developments from the SEC, FTC, presidential executive orders, GDPR, and state privacy laws. Talk to peers and outside counsel. Various regulations and laws could impact the firm’s approach to AI and shape its policies.

Source: Gartner’s 2023 Top Legal & Compliance Technology Predictions