In recent years, rapid industry growth, heightened competition, and increased regulatory scrutiny have made fund management exponentially more complex. Private equity firms and investment banks want to use technology to manage the legal workloads arising from this complexity, but few technology providers build contract lifecycle management (CLM) and contract automation solutions with private markets in mind. Most CLM software solutions lack the features private fund managers and investment bankers need, and firms that adopt generic solutions don’t achieve the efficiency and money savings they expect.

Because of the disadvantages of generic CLM and contract automation solutions, Ontra developed Ontra Synapse, artificial intelligence (AI) that supports a legal operating system (legal OS) for private markets. From AI-enabled contract negotiations to proactive obligation management, private fund managers use Ontra’s legal OS to improve their contract management workflows, rely less on outside counsel, and free their internal teams to focus on mission-critical work.

Understanding contract automation and intelligence technology

Legal tech providers often tout different types of technology in their marketing materials. But what do terms like AI and contract automation really mean? Let’s define common types of technology and how they relate to contract automation and intelligence.

What is AI?

AI focuses on the creation of machines capable of performing complex tasks that typically require human intelligence.

What is machine learning?

Machine learning uses algorithms and statistical models to analyze and learn from patterns in data without people’s input.

What is natural language processing?

Natural language processing (NLP) enables machines to recognize, understand, translate, and generate human language on their own.

What is contract automation?

Contract automation uses numerous technologies — including NLP, machine learning, and AI — to perform tasks associated with the contract lifecycle that humans usually handle.

What is contract intelligence?

Contract intelligence integrates NLP, machine learning, and AI outputs within CLM software to provide individuals with answers, predictions, and other information when they perform contract-related tasks.

What is Ontra Synapse?

Ontra Synapse is the proprietary AI technology powering FundFormer, Contract Automation, and Insight — Ontra’s applications that help firms manage legal workflows associated with fundraising, portfolio investing, and fund operations.

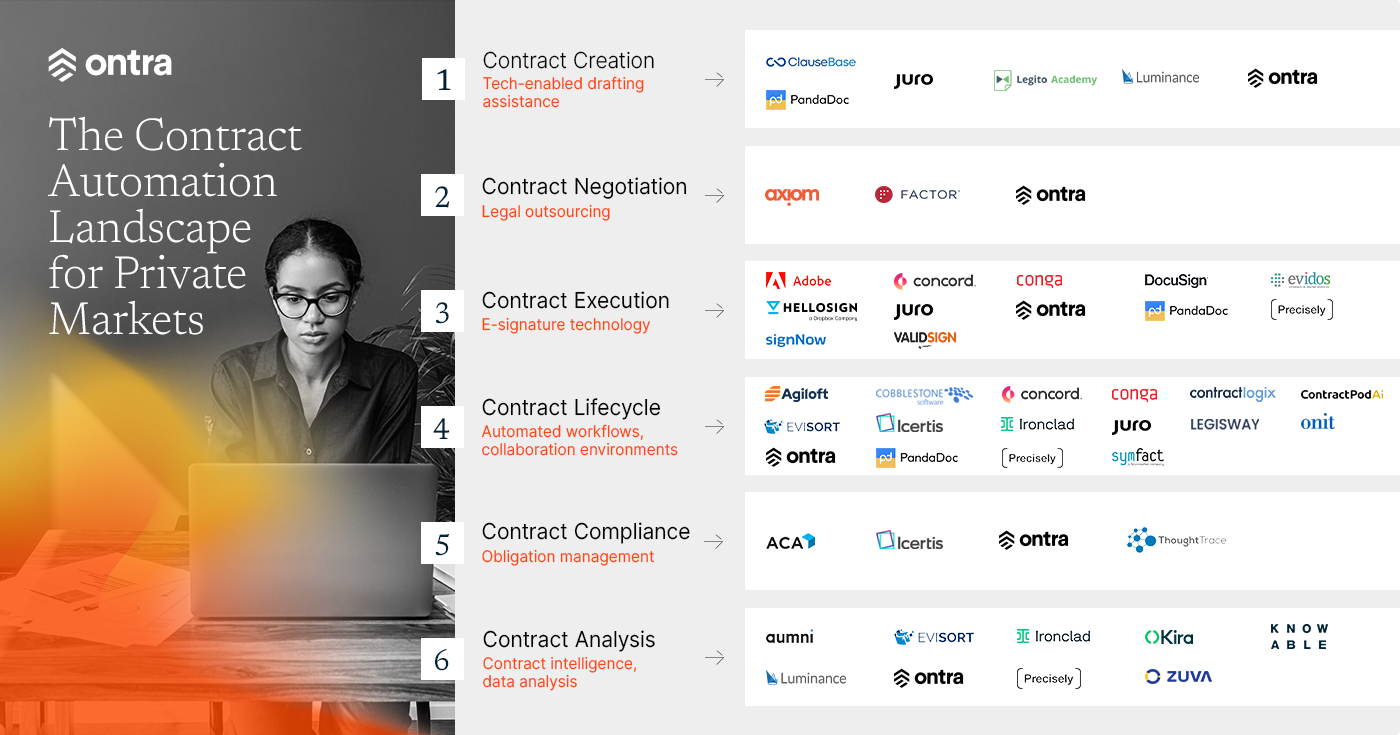

Types of contract automation solutions for private markets

Given the proliferation of AI-based contract management and contract automation software, private markets firms should evaluate AI solutions to determine which are appropriate for their specific legal workflows versus generic purposes.

Contract creation solutions

Some legal technology solutions focus on providing tools to help with drafting agreements. However, drafting and contract creation technology is rarely industry-specific. Many solution providers intend for their solutions to enable any business to upload basic contract templates or create clause libraries for simple commercial agreements, which employees can reference to draft agreements.

Ontra differs from other contract drafting solutions because its solutions are tailored specifically for the complex agreements common in the private funds industry. With more than 800,000 contracts processed and the world’s largest database of private equity NDA terms, Ontra enables private fund managers and investment bankers to quickly generate routine contracts by leveraging customized playbooks and in-depth market knowledge.

AI-assisted contract negotiations

Several service providers connect businesses with freelance lawyers for routine contract negotiations. These providers can be particularly helpful for operating companies managing a high volume of simple, but repetitive contracts. Investing in a larger in-house legal team or relying on expensive outside counsel may not make sense for those companies.

While most legal outsourcing providers market to a wide range of customers, Ontra focuses on the nuances of private funds and deals. Its global network of experienced lawyers uses Ontra’s AI-backed software when negotiating routine contracts for asset managers, private funds, and investment banks.

eSignature providers

Though many asset managers, private funds, and investment banks use eSignature technology, it’s rare for them to use contract management software with this integration. Instead, they use a separate eSignature platform as an ad hoc solution to collect signatures.

Ontra’s Contract Automation for private markets has DocuSign integrated directly into investment and fundraising-specific workflows. As a result, Ontra’s legal network members can create and email a DocuSign document through Ontra’s application. Customers receive a link in an email through which they can sign the document via DocuSign, completing a simple and efficient workflow.

Contract lifecycle management

Drafting, negotiation, workflow, and obligation management features vary from one CLM platform to the next, making some more attractive to private markets firms than others. However, while many CLM providers target financial services, they rarely market to asset managers, private funds, investment banks, or, more specifically, the private equity industry.

Ontra’s suite of solutions automates contract management processes associated with fund formation and private markets dealmaking. Insight by Ontra provides asset managers and fund managers with a central location to digitize and store key fund and investor documentation — including limited partnership agreements and side letters — creating a searchable, single source of truth. Most importantly, Insight is intuitive and easy to use because Ontra based it on private asset managers’ needs and workflows.

Contract compliance solutions

Compliance solutions for private markets are rare, and providers often gear their solutions toward personal trading, regulatory compliance, and administrative approvals. Few solutions address managing obligations to investors found in fund documentation and side letters.

Insight by Ontra addresses the lack of an obligation management solution for private markets. Its features enable private fund managers and asset managers to proactively track and meet their commitments to investors instead of relying on manual or reactive processes that could lead to non-compliance, disputes, and reputational damage.

An additional benefit of Insight is a comprehensive audit trail that enables private fund managers to quickly provide documentation and respond to requests during a regulatory exam.

Contract intelligence

With the advent of digitizing contracts comes the ability to turn contract provisions into structured and usable data. Technology providers are building CLM solutions with AI that can analyze documents, categorize data, and generate reports.

Due to Ontra’s AI models’ deep understanding of the structure of industry contracts and industry terms, Ontra enables accurate contract summarization, precedent retrieval, and reporting features. Fund managers can surface current and historical contract data, easily finding a provision in an individual contract or generating reports across large document sets.

Contract automation built for private markets

Contract Automation from Ontra is a superior way for private fund managers, asset managers, and investment bankers to negotiate, manage, and comply with routine contracts. Ontra tailored its application to the unique needs of private markets by training the AI-enabled features on over 800,000 industry-related documents instead of generic, open sources like Wikipedia or unrelated commercial contracts.

Firms don’t have to accept conventional legal tech solutions that could introduce risk into their processes when they can confidently rely on an industry-specific solution.