Handling routine legal work in-house isn’t an efficient use of businesses’ internal resources. Repetitive commercial contracts pull in-house lawyers and other business professionals away from mission-critical work. This constant task switching reduces their productivity and, in the long run, can lower employee morale and contribute to burnout. Companies’ other option is to send high-volume, routine contracts to outside law firms with high price tags and slow turnaround times.

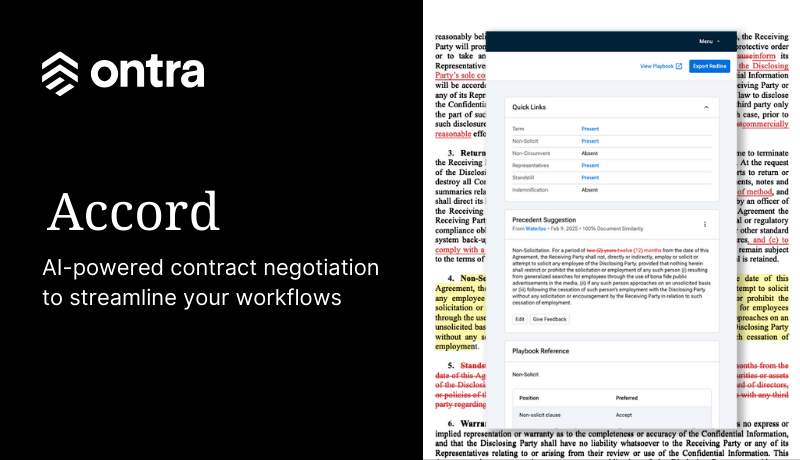

The more efficient option is to partner with a Contract Automation provider. Instead of relying on traditional outsourcing arrangements, businesses can look to automation. As a legal process automation provider, Ontra combines artificial intelligence and a distributed network of high-quality freelance lawyers to quickly and dependably process routine contracts.

Types of business contracts to automate and outsource

1. Confidentiality agreements

Confidentiality and non-disclosure agreements are contracts between parties to keep certain specified information confidential. For example, under a private equity NDA, asset managers, investment banks, deal targets, vendors, or other business partners agree not to disclose trade secrets, financial information, business plans, or other sensitive information to third parties unless the contract provides exceptions.

Most companies use confidentiality agreements and NDAs for repetitive transactions, such as when hiring employees and independent contractors. In many cases, the key provisions within the agreement don’t change significantly from document to document. Most NDAs include similar terms, focus on the same key issues, and use similar language and provisions.

2. Joinder agreements

Businesses frequently use joinders to bind new parties to existing contracts, such as NDAs, shareholder agreements, trust agreements, or partnership agreements. Unlike the underlying contract the joinders refer to, which might require complex negotiations and nuanced wording, these agreements are usually fairly standard.

Because a joinder agreement binds the joining parties as if they were parties to the original agreement, the underlying contract sets the terms of the agreement, and businesses go through minimal negotiations.

3. Engagement letters

Many business relationships start with an engagement letter that defines the transaction and the scope of the parties’ relationship and expectations. For example, in the private markets, businesses preparing for M&A transactions often engage diligence providers or investment banks to assist in completing deals. These third parties provide crucial services to the M&A process and are often engaged on a repeat basis for new transactions.

Like NDAs, engagement letters have fairly standard provisions, and parties frequently negotiate only a few commercial clauses.

4. Non-reliance letters

Before any significant transaction, buyers and sellers typically engage third-party service providers to conduct due diligence for legal, accounting, tax, or other purposes, and those providers produce reports outlining their relevant findings. Before companies can share those reports with other interested parties, like banks or other service providers, most diligence providers require new recipients to sign non-reliance letters.

A non-reliance letter states the report is for information purposes only and the information contained in the report can’t be the basis for any future legal claim against the diligence provider by the new recipient.

Non-reliance letters are standard documents that incorporate routine clauses protecting the diligence provider issuing the letter from liability. Most providers will use the same letter in every instance, changing only the names of the involved parties and the description of the underlying transaction.

5. Vendor contracts

Most companies work with several vendors at any given time, each with its own agreement defining the scope of the goods or services the vendor provides. The details of how businesses interact with their vendors are usually well established, from confidentiality to security measures. The vendor generates these agreements, and they may not be open to substantial negotiation. As a result, there are only a handful of key terms for companies to review. In some cases, the review is as simple as changing party names and inserting standard language.

6. Consulting agreements

Like engagement letters, consulting agreements define the relationship between a business and a service provider, often an individual consultant. The contract typically lays out the services the consultant will provide, the duration of the relationship, and the compensation, in addition to other standard contract provisions, such as venue, choice of law, confidentiality, and dispute resolution.

Businesses that work with consultants often likely have a standard consulting agreement, which outlines the broad terms of the relationship. The business and the consultant then thoroughly define the scope of the relationship in a statement of work. In these circumstances, businesses can turn over high-volume consulting agreements to a legal process automation provider.

7. Employment agreements

Many businesses require new employees to sign an employment agreement, which dictates the rights and responsibilities of each party. The contract might include terms for compensation, confidentiality, tax responsibilities, termination, choice of law, and dispute resolution.

Most likely, the business dictates the terms of this agreement, which means there will be hardly any variation from one employment contract to the next. A business with a high volume of employment agreements and other routine contracts can help its human resources or people team by automating and outsourcing these agreements.

8. Standard service agreements

Standard service agreements, also known as services agreements or general services agreements, lay out the rights and responsibilities between service providers and customers. This agreement defines the services the business provides, including whether it’s a one-time service or an ongoing relationship. The contract also typically includes provisions for pricing, payment terms, late fees, choice of law, indemnification, dispute resolution, and termination.

Most businesses that need a standard service agreement use a template for each customer since it creates a uniform relationship between a service provider and hundreds, if not thousands, of customers. In rare cases, a customer can negotiate the contract, and the business might accept minor changes to the agreement.

9. Indemnity agreements

Indemnity agreements shift risk within a business relationship by protecting a party from certain liabilities, such as lawsuits or third-party claims, that might arise in relation to the transaction. Other names for these agreements include a release of liability, a waiver of liability, a no-fault agreement, or a hold harmless agreement.

An indemnity agreement can be a separate contract between two parties, although more often it’s an indemnification clause within a broader contract. Businesses that use a standard indemnification agreement might find legal outsourcing and automation faster and more efficient than processing these contracts in-house.

10. Property leases

Most property leases include standardized terms based on state and local law, as well as the property owner’s policies. Residential tenants have little to no ability to negotiate these leases. In contrast, commercial tenants usually have room to negotiate terms. For example, some commercial tenants negotiate base rent and adjustments, utilities, tax liability, renovations, repair obligations, and exclusivity for their business type.

Businesses with numerous properties can use contract outsourcing and automation to move prospective tenants through lease signing faster. Even on commercial leases that require negotiations, the right outsourcing provider offers experienced freelance lawyers to oversee this process.

11. Real estate documents

Buying and selling commercial real estate is a long, complex process. These transactions require a host of standard documents, including a letter of intent, access agreement, purchase and sale agreement, assignment and assumption of leases, and bill of sale. Businesses that routinely navigate these contracts and legal documents can work with an outsourcing vendor that offers contract automation and freelance lawyers.

12. Access agreements

Through an access agreement, a property owner can give another party, usually an adjoining property or prospective buyer, the right to come onto or use the property. Parties commonly sign an access agreement during a commercial real estate transaction to enable the buyer to perform inspections and plan renovations.

Most access agreements include standardized provisions, such as inspection limitations, notice requirements, confidentiality, duration, and indemnification, which must abide by any relevant state laws. Given this standardization, businesses handling a high volume of access and other real estate agreements benefit from partnering with a legal outsourcing provider.

13. Franchise documents

Franchise businesses navigate the same legal documents with franchisees over and over, including the franchise disclosure document, franchise agreement, operations manual, registration application and notices, and financial statements. Many of these agreements and legal documents stay the same from one franchisee to the next, enabling businesses to use legal outsourcing and freelance lawyers to speed up the contracting process.