Most Favored Nations (MFN) elections are still a manual, inefficient, and expensive process. General partners (GPs) typically rely on their outside counsel to run MFN elections, and most law firms lack a software solution to support the election process. Law firms continue to rely on manual workflows and decentralized sources of information, limiting the GP’s visibility into the process, increasing costs, and expanding MFN timelines upwards of 9-12 months.

With digital MFN elections (dMFN) through Ontra’s Insight, a lengthy and costly MFN process is no longer inevitable.

With dMFN, private fund managers and their counsel can:

- Generate MFN election forms based on the fund’s digitized side letters in minutes.

- Distribute forms via a secure digital portal or export PDFs to send via email.

- Track investors’ completion status.

- Review and approve investors’ elections.

- Automatically update the fund’s digital compendium to create a single source of truth for all investor obligations.

Ultimately, GPs and their outside counsel can use Insight to negotiate favorable side letter terms, run efficient MFN elections, and manage the resulting obligations in a single, AI-powered platform.

To see dMFN in action, schedule an Insight demo today.

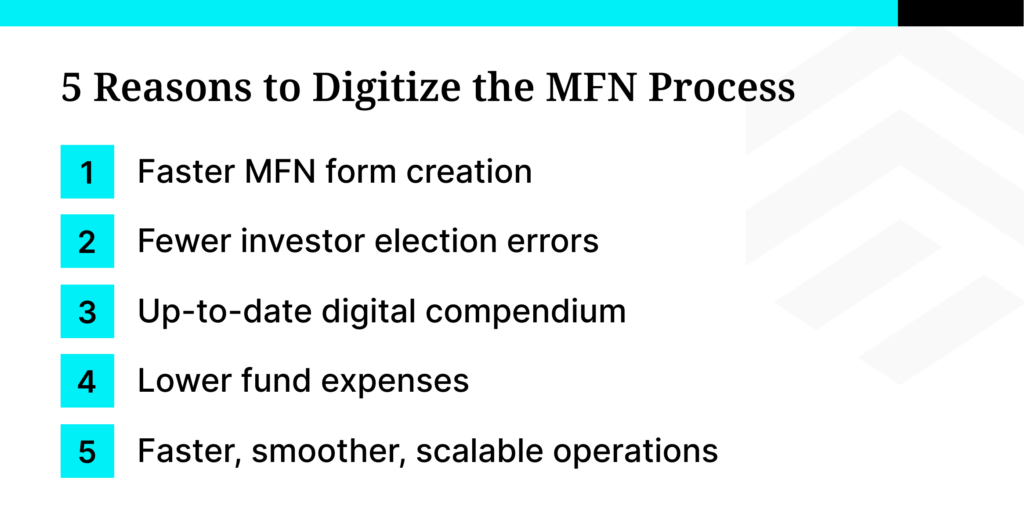

5 reasons to digitize the MFN process

1. Faster MFN form creation

Creating MFN forms has always been one of the most challenging and time-consuming aspects of the MFN process. Insight’s dMFN feature makes form creation much easier and faster.

With Insight, GPs immediately convert side letters to digital documents with categorized obligations. Once digitized, GPs can search and filter through commitment thresholds and investor characteristics to determine electable provisions and generate MFN forms. GPs or their counsel can distribute the MFN forms through Insight or as a PDF via another method, such as email or an investor portal.

What was once one of the most protracted and challenging manual processes in the MFN workflow now becomes a task GPs, or their counsel can complete in minutes in Insight.

2. Fewer investor election errors

GPs and their counsel have several ways to navigate MFN forms for many investors. Some choose a “universal” form, which investors must scour to determine their electable provisions. Other firms ease investors’ burdens by providing MFN forms limited to a specific investor or investor type. Investors routinely make erroneous selections, whichever the GP’s choice, due to confusing instructions or the inability to redline and compare their choices.

MFN forms delivered via Insight allow investors to leverage Insight’s redlining capability to review their options carefully. Not only are investors’ choices marked clearly on forms generated in Insight, but the review capabilities make the MFN process more accessible for investors. Overall, GPs and their outside counsel deal with fewer errors and minimize back-and-forth communications with investors.

3. Automatically up-to-date digital compendium

Another painful point in the MFN election process is updating the firm’s compendium and other records indicating the GP’s new contractual obligations to investors. For firms relying on massive spreadsheets or Word documents, this could take their outside counsel weeks.

For the dMFN process, once the GP or their counsel accepts an investor’s elections, Insight automatically reflects the elections as obligations. As a digital compendium, Insight is automatically up to date, and outside counsel avoids any need to make manual changes to side letters, spreadsheets, and other documents.

4. Lower fund expenses

Cost is a critical pain point for GPs that navigate large, complex MFN elections. Outside counsel typically bills for several associates’ time over weeks and months, and it’s not uncommon for MFN election fees to exceed expense caps.

Insight is accessible to both the GP and external counsel. GPs that continue to have external counsel run their MFN elections could see a reduction in the law firm invoices, given that generating MFN forms, reviewing investor elections, and updating the compendium take less time. GPs that move MFN elections in-house would see an even more significant reduction in outside counsel fees.

5. Faster, smoother, scalable operations

Most GPs intend for MFN elections to take up to 90 days after the fund’s final close, yet inefficient processes often push that out to 9-12 months. During these months, GPs lack visibility into the MFN process and their obligations to investors, putting their compliance at risk.

With Insight from Ontra, every step of the MFN election process, from form generation to obligation compliance, is faster with the help of AI and automation. At any time, a GP’s internal stakeholders can see which MFN election forms have been created, sent, received, and approved in Insight.

With streamlined and automated processes, GPs are better positioned to tackle future MFN processes involving more side letters and complexity. They have the AI-powered platform they need to scale with new products and funds.

Demo dMFN elections today

MFN elections don’t have to take months and exceed expense caps. With AI-powered Insight, GPs and their outside counsel can enjoy faster, easier MFN elections.

Ready to learn more? Schedule an Insight demo today.