The private equity industry and its players are evolving, and one aspect of that growth is investing more in legal talent. Large asset management firms have had internal legal teams for years, while smaller firms often rely on business professionals and outside counsel to perform legal tasks. As these smaller PE firms grow AUM and sophistication, though, they’re bringing in GCs to oversee legal tasks, employment issues, regulatory compliance, obligation management, and deals.

For firms to benefit fully from their investments in legal talent, they also need to implement legal technology and AI. Adopting the right tech allows GCs to efficiently mitigate risk and drive value for their firms.

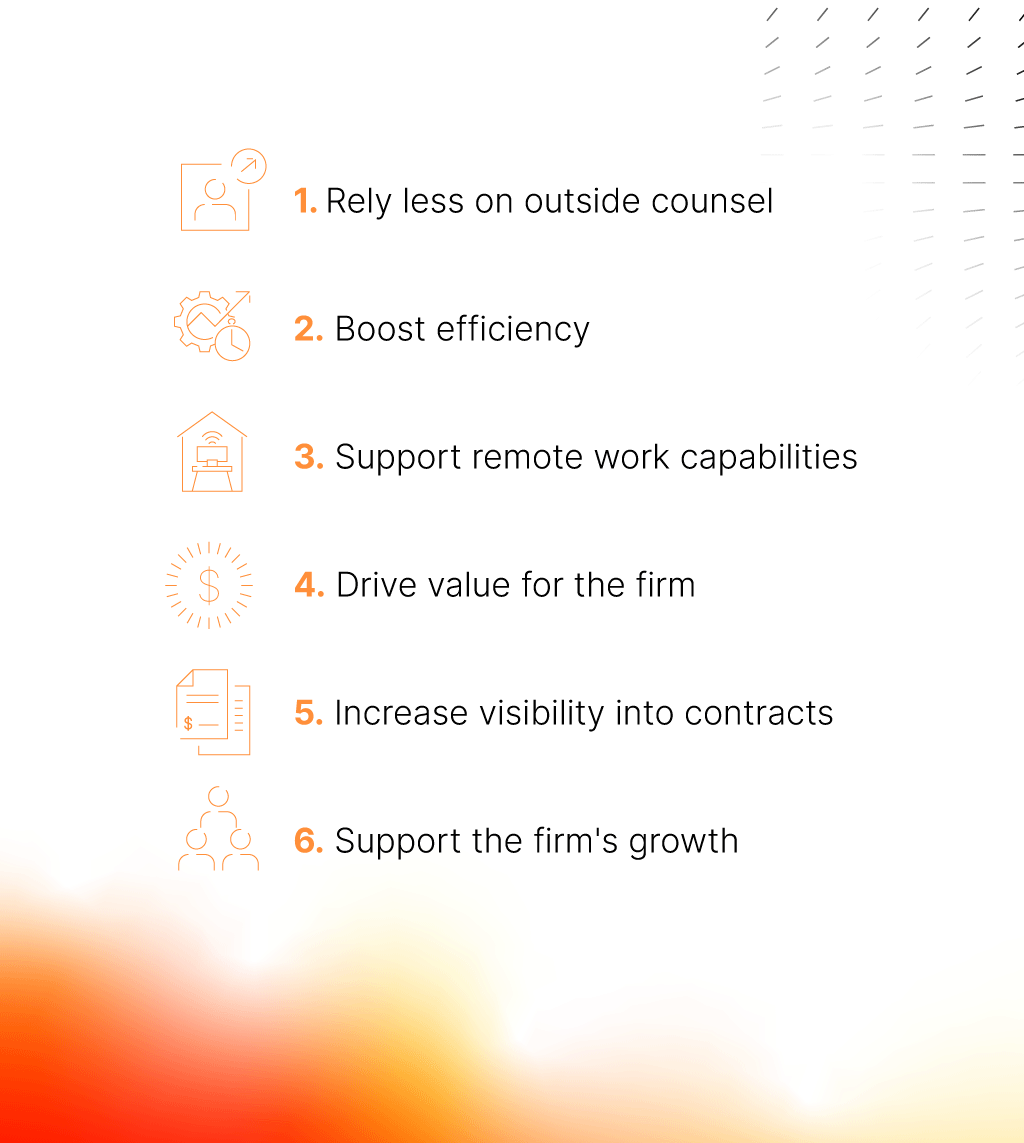

6 reasons why in-house legal departments need legal tech

1. Rely less on outside counsel

While PE firms will continue to work with outside law firms, they’re mindful of monthly invoices. For some, the cost of outside counsel is top of mind as they work to avoid rising operational expenses. Providing their legal talent with legal tech and industry-specific AI tools enables firms to perform more tasks in-house, thereby reducing their spend on outside counsel.

2. Boost efficiency

Even as the private markets adjust to rising interest rates, supply chain issues, the Ukraine-Russian war, and other global events, there’s still plenty of work to be done in terms of fundraising, sourcing deals, and ensuring regulatory and contract compliance. Because PE firms tend to maintain lean legal teams — with each lawyer and staff member wearing many hats — these teams need legal tech to help them work efficiently, meet the firm’s expectations, and reduce the risk of burnout.

3. Support remote work capabilities

COVID-19 and stay-home orders forced a shift from traditional office culture to remote work. PE firms had to be agile and adopt technology that allowed their lawyers and business professionals to communicate, collaborate, and maintain productivity as distributed teams. Many firms had to make quick choices in 2020 and are left with a patchwork of applications. Since remote work is here to stay, now is the time to upgrade to comprehensive solutions.

4. Drive value for the firm

In-house legal departments don’t have to be cost centers for PE firms. Legal technology that gives GCs access to structured data and reporting capabilities allows them to analyze investment, contract, and other business data. Ultimately, data-driven insights enable GCs to pursue greater productivity and growth for their firms, turning the legal department into a value center.

5. Increase visibility into the firm’s agreements

Decentralized document and contract storage plagues PE firms; but with legal tech, firms can better store, search, and analyze their fund documents. Enhanced visibility into the firm’s agreements supports mature contract compliance programs, informs future negotiations, and can assist with audits.

6. Support the firm’s growth

Not every PE firm strives for the size and AUM of KKR and Blackstone. Yet growth is always top of mind. In-house legal teams with the right tech and ability to analyze data can help their firms gain new investors, launch new strategies, and enter new markets while mitigating risk.

What to include in a PE firm’s legal tech stack

GCs of PE firms need the same basic tech solutions all businesses rely on at this point — Microsoft Office Suite and an email platform — but they can’t rely on those alone if they hope to be as efficient and productive as possible.

Collaboration tools: Collaboration tools such as Slack, Teams, or Zoom are essential for business and legal professionals to communicate quickly and hold meetings among themselves, with investors, and with other stakeholders.

A document repository: Document management or contract management software centralizes contract and document storage — a more secure alternative than saving business contracts and legal documents on various devices. By digitizing and consolidating documents, employees can access and search them from anywhere, improving their ability to take advantage of data.

A contract lifecycle management (CLM) solution: PE firms tend to handle dozens or hundreds of agreements annually, ranging from routine NDAs to highly complex limited partnership agreements and side letters. Most firms benefit from a CLM software solution that offers more than centralized storage, including drafting, negotiation, electronic signature, and compliance features.

A subject matter resource: Legal teams need access to a legal research platform such as Westlaw, LexisNexis, or Bloomberg Law to perform in-depth legal research in-house and reduce reliance on outside counsel.

A time tracker: In-house lawyers might not bill by the hour, but it may still be important to track their time spent on various tasks, particularly when some costs associated with internal legal work are borne by funds. Further, by measuring and analyzing time spent on different legal tasks, GCs can evaluate their team’s productivity and determine if routine tasks are taking up too much of their lawyers’ time.

Legal spend management software: A legal spend solution lets in-house teams track how much work they send to outside counsel and forecast future spend. These capabilities enable firms to make data-driven decisions regarding which tasks to keep in-house, send to a legal outsourcing provider, or send to outside counsel. Spending data and forecasts might also signal when it’s time to reevaluate fee agreements.

A regulatory compliance solution: PE firms with lean teams might combine the role of GC with the chief compliance officer. This busy legal professional needs an effective regulatory compliance solution, particularly as the private markets currently face intense regulatory scrutiny and evolving regulations.

Communications archiving and monitoring: PE firms should archive and monitor email, instant messages, voice messages, social copy, email marketing, and other content to mitigate risk, meet regulatory compliance requirements, and analyze data to inform business decisions.

A password manager: It’s impossible to build an in-house legal team’s tech stack and not consider basic cybersecurity measures. A password manager is a simple way to encourage employees to use strong, unique passwords for each software solution.

How AI fits into legal tech

AI looms large right now, and legal tech providers are rapidly incorporating machine learning, natural language processing, large language models, and AI models into their solutions. In many cases, these advanced technologies automate particular legal tasks or support lawyers’ more complex and nuanced work.

For example, PE firms might benefit from a contract intelligence solution, which offers AI outputs within a contract management system. The AI outputs could be search results from a predictive AI model or suggested contract language from a generative AI model.

Consider alternative legal service providers

PE firms should consider partnering with an ALSP that offers a combination of legal tech solutions and legal outsourcing services.

For instance, firms might be interested in automating and outsourcing their private equity NDAs to avoid keeping a high volume of routine contracts in-house. Ontra pairs a Contract Automation platform with a global Legal Network, enabling our customers to negotiate NDAs quickly, store executed agreements in a central contract repository, and analyze their NDA data to inform future negotiations.