Asset management firms can mitigate risk by performing contract compliance audits. Reviewing all or some of the firm’s contracts can ensure it and other parties are complying with their agreements. Not only can this process strengthen the firm’s relationships with investors, it also supports the firm’s regulatory compliance efforts.

What is a contract compliance audit?

A contract compliance audit is a business’s review of all or some of its contracts to determine whether it and other parties are honoring their agreements. Contract audits can be as narrow as reviewing one or a few contracts or as broad as reviewing all an organization’s agreements.

How can businesses identify contract compliance risk?

All businesses face some amount of contractual risk. The more important question is how each business identifies and addresses those risks.

For example, with the help of their in-house counsel or outside law firm, asset managers can carefully review the obligations and risks that could arise from employment contracts, vendor contracts, non-disclosure agreements, limited partnership agreements, side letters, and other agreements.

The next step is for managers to define how they’ll ensure contractual compliance, which might include using a contract management solution and performing contract compliance audits.

Firms that are unsure of their level of risk and how to best mitigate it may benefit from adopting an end-to-end contract management platform that offers greater transparency into their contracts and obligations. Many asset managers run into compliance issues due to the inability to quickly drill down into agreements. Instead, reviewing individual agreements or comparing provisions across a contract type is a time-consuming, manual process. Contract automation technology backed by artificial intelligence can reduce this pain point and improve firms’ contract management programs.

When should businesses perform contract compliance audits?

Businesses can audit their contracts to search for noncompliance or in reaction to an event.

Proactive contract compliance audits

Businesses can establish a regular cadence for proactive contract compliance audits, such as an annual audit. Proactive contract reviews typically have a broader purpose and scope than reactive contract compliance audits. That said, asset management firms might audit a specific agreement, a certain contract type, or all the firm’s agreements within a fund or with vendors.

The purpose of proactive contract reviews varies significantly. For example, businesses might review all vendor contracts to confirm billing accuracy and uncover any areas of noncompliance. Or asset managers might review all agreements with investors, such as side letters and LPAs, to ensure they meet all their affirmative obligations.

Reactive contract compliance audits

Reactive contract reviews typically respond to a particular event and have a specific purpose, such as reviewing the risk associated with a key personnel change or coordinating with a financial audit when preparing for an M&A transaction. A responsive contract review doesn’t mean anything has gone wrong, though concern over a specific party’s performance could trigger an audit of a particular contract type.

Reasons to audit a firm’s contracts include:

- A merger or acquisition

- A significant structural change to the business

- Debt or equity financing

- A significant personnel change

- Contract renewal negotiations

- A substantial capital expenditure

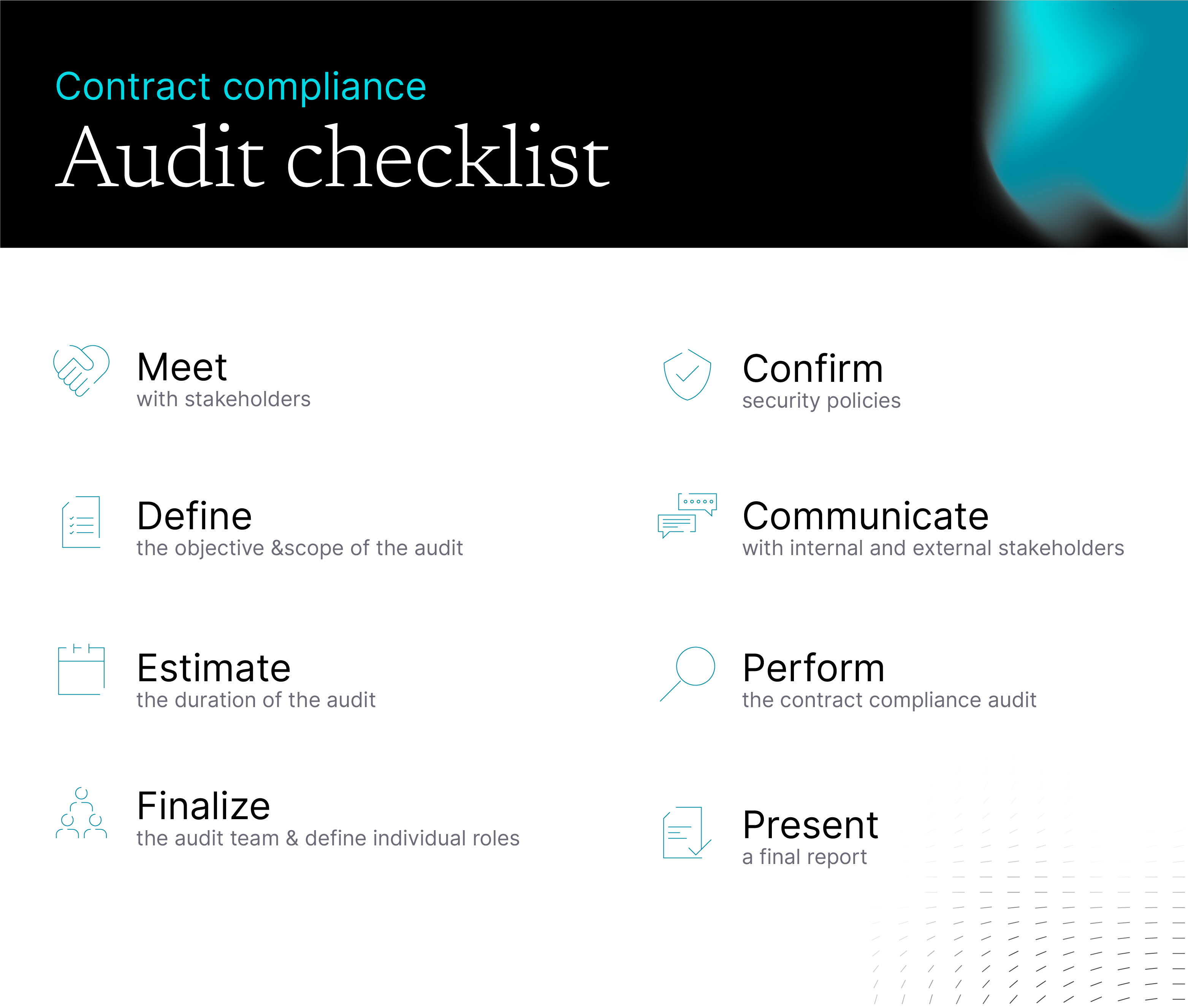

The contract compliance audit process

- Meet with the relevant internal stakeholders: The person in charge of compliance should select and meet with the necessary internal stakeholders. Legal, compliance, finance, or another department might lead the process depending on the nature of the audit.

- Outline the objectives of the audit: Established objectives enable the team to measure whether the audit succeeded and, if not, whether the business should alter its process in the future.

- Define the scope of the audit: The stakeholders will decide which contract types to review based on the purpose of the audit. They may review one or more specific contract types or all of the firm’s contracts with investors or outside parties.

- Consider the timing of the audit: Depending on the nature of the audit, it may take weeks or months. The stakeholders should estimate the time internal and external parties will take to perform the audit. Then, given the estimated time commitment, stakeholders can determine when it’s appropriate to begin the audit.

- Finalize the audit team: Before the business begins the audit, it should finalize who is part of the audit team, including external resources it hires for the project.

- Define the individual roles within the audit team: Each team member should have a clear vision of their role within the audit process and to whom they report.

- Define the security policies relevant to the audit: Leadership must consider confidentiality and information security during the audit. The internal and external stakeholders should have only the access necessary to perform their tasks.

- Communicate expectations with the audit team: Given that multiple business and legal professionals from various departments may participate in the audit process, it’s important for leaders to communicate the commitment required from each department or individual. Open communication regarding the time commitment and purpose of the audit is essential for a smooth process.

- Draft external communications: If the business needs outside parties’ cooperation to perform a thorough audit, it should communicate to outside parties that it’s performing the review. This notice may be necessary when auditing vendors’ billing and delivery of goods or services.

- Draft and present the final audit report: After finishing the audit, the team should draft a report of its method, findings, and recommended next steps.

The benefits of contract compliance audits

Asset management firms can derive numerous benefits from proactive and reactive contract compliance audits, including cost savings, risk mitigation, process improvements, and stronger business relationships.

Cost savings

When businesses evaluate vendor contracts, they might find instances of noncompliance that impact the value they receive or how much they pay. Correcting these issues and ensuring accurate billing can save them money.

Risk mitigation

While many contract compliance audits focus on other parties’ performance, businesses can also evaluate their own performance. For asset managers, ensuring compliance with their agreements reduces the risk of harming essential business relationships and litigation. Confirming the firm honors its agreements with investors also improves SEC compliance.

Process improvements

A thorough contract compliance audit might uncover problems with a business’s contract management program. For instance, there may be no controls to alert the general counsel, chief compliance officer, or another individual to a specific notification or reporting requirement. In recognizing this issue, the business can begin to consider a contract lifecycle management solution.

Strengthened business relations

Businesses might worry a contract compliance audit will offend or worry other parties if they need their cooperation or if the business finds instances of noncompliance. However, a contract review can positively impact relationships with vendors, investors, and other parties when companies handle external communications well. Ensuring contractual compliance is a way to build trust and long-term relationships.